When a lender forecloses on a property, they will typically put the property up for auction.

In the case that both owners were previously sharing the financial responsibilities of the property, the spouse who ends up with the house may no longer be able to afford the monthly mortgage repayments on their own, resulting in foreclosure. The previous owners get divorced: If the previous owners get divorced, one spouse may be left with the mortgage.As a result, the property may end up in foreclosure. In some cases, the deceased owner may not have had a family to leave the property to. The previous owners pass away: If the previous owners die, their estate may not have enough money to pay off the mortgage.Life happens, and sometimes people experience financial hardship that makes it difficult, if not impossible, to keep up with their mortgage payments. The previous owners can’t afford to pay the mortgage: This is the most common reason for foreclosure.The following are a few of the most common reasons why a lender will foreclose on a property: Reasons For ForeclosuresĪs previously mentioned, a foreclosure occurs when a homeowner fails to make their mortgage payments, and the lender is forced to repossess the property. The following guide will provide you with everything you need to know about the risks of investing in foreclosures so that you can make an informed decision about whether or not this type of investment is right for you. While there are certainly some great deals on foreclosed properties, it’s important to remember that they also come with a certain amount of risk. Foreclosed properties often present investors with an opportunity to purchase real estate at a significant discount.

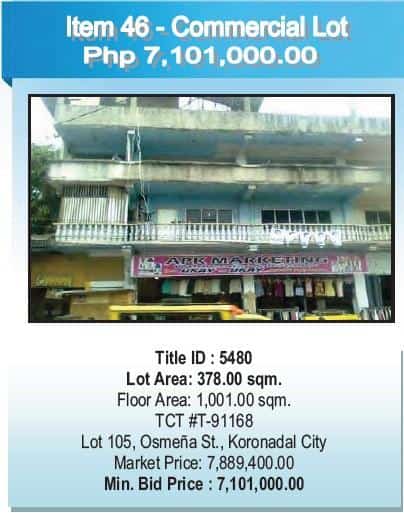

A foreclosed property is a piece of real estate that has been repossessed by a lender after the previous owner failed to make their mortgage payments. As a real estate investor, there are many different types of real estate investment opportunities to consider.įor example, many investors will scour the market for foreclosed properties.

0 kommentar(er)

0 kommentar(er)